Annuities are essentially insurance contracts. A series of payments to be received during a period of time.

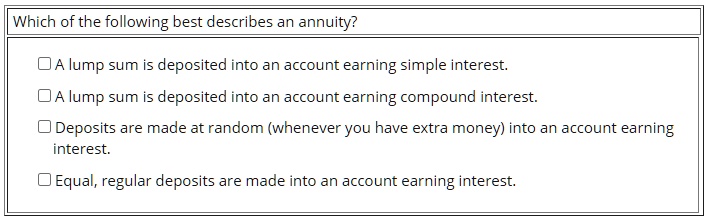

Solved Which Of The Following Best Describes An Annuity Oa Lump Sum Is Deposited Into An Account Earning Simple Interest Oa Lump Sum Is Deposited Into An Account Earning Compound Interest Deposits Are

Equal cash flows at equal time intervals forever B.

. You pay a set amount of money today or over time in exchange for a lump-sum payment or stream of income in the future. Multiple Choice C Series of cash inflows of varying amounts collected at the end of each period O Series of cash flows of equal amounts collected at the end of each period Series of cash flows of varying amounts collected at the This problem has been solved. Solved Which Of The Following Best Describes An Annuity Oa Lump Sum Is Deposited Into An Account Earning Simple Interest Oa Lump Sum Is Deposited Into An Account Earning Compound Interest Deposits Are.

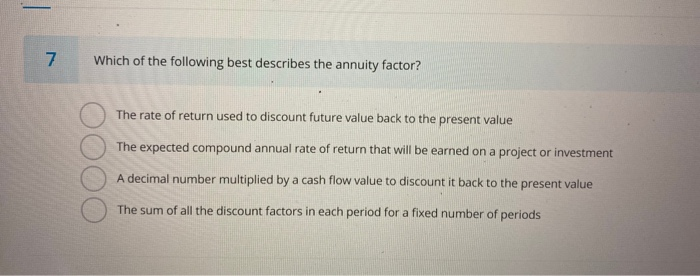

The annuity period is the time during which accumulated money is converted into an income stream. The period of time during which accumulated money is converted into income payments Which of the following best describes what the annuity period is. A-- a series of unequal cash payments made at equal time intervals.

The period of time from the accumulation period to the annuitization period 4. Equal cash flows at equal time intervals forever B. In an annuity the accumulated money is converted into a stream of income during which time period.

Which one of the following statements best describes an ordinary annuity. Which of the following is true regarding the annuity period. Equal cash flows at equal time intervals for a specific time period C.

An annuity due is an annuity with payment due or made at the beginning of the payment interval. Joint and 100 survivor joint and two-thirds survivor or joint and 50 survivor. By soetrust April 16 2022.

Lumpy cash flows at equal time intervals for a specific time period Answer. If an annuitant dies before annuitization occurs what will the beneficiary receive. Fines of up to 1000 for each act.

All payments are in the same amount such as a series of payments of 500. It has the following characteristics. Lumpy cash flows at equal time intervals forever D.

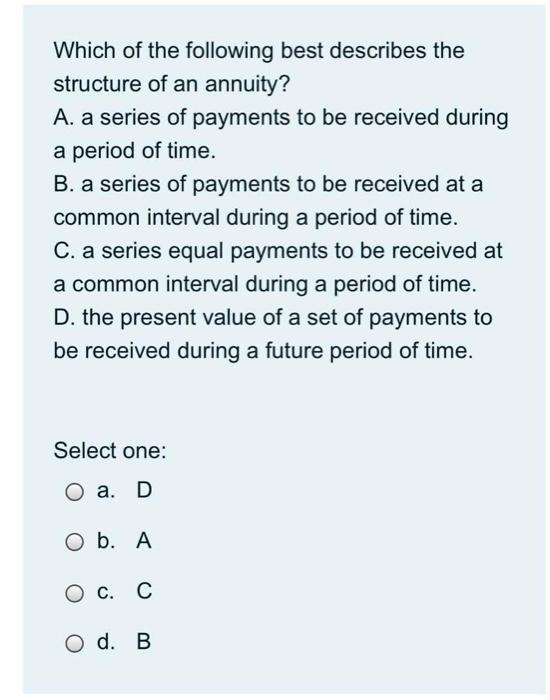

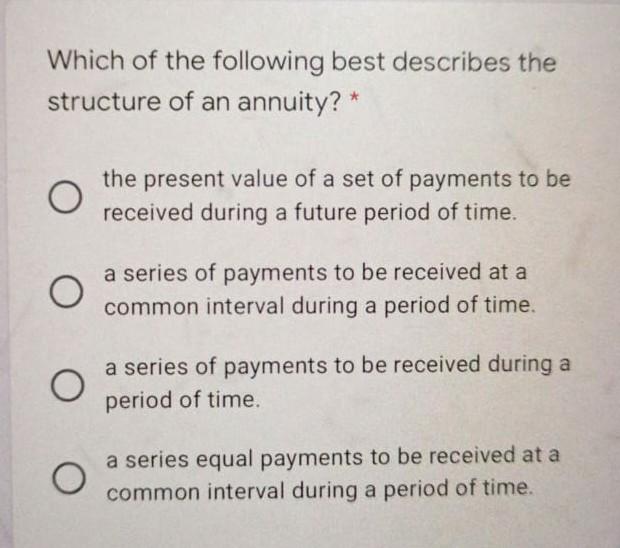

All payments are made at the same intervals of time such as once a month or year. Which of the following best describes the structure of an annuity. The Bottom Line.

Which of the following most accurately describes the term annuity. The Accounting Rate of Return method evaluates the lifetime return of an investment whereas Return on Investment evaluates the annual return of an investment. A series equal payments to be received at a common interval during a period of time.

A The period of time spanning from the accumulation period to the annuitization period b The period of time during which money is accumulated in an annuity c The period of time spanning from the effective date of the contract to the date of its termination. Lumpy cash flows at equal time intervals for a specific time period 1 answers 0 vote. Lumpy cash flows at equal time intervals forever D.

A series of payments to be received at a common interval during a period of time. For example if the annuitant was receiving 1000 monthly under a joint and 50 survivor option the survivor would receive 500 monthly. Which of the following best describes what the annuity period is.

The period of time during which accumulated money is converted into income payments 3. Finance questions and answers. The joint-survivor option is usually chosen as one of three alternatives.

An annuity due is a repeating payment that is made at the beginning of each period such as a rent payment. Secondly how is an annuity paid out. Equal cash flows at equal time intervals for a specific time period C.

The period of time from the effective date of the contract to the date of its termination 2. Which Is The Best Option For An Annuity Settlement. Examveda Which of the following statements best describes an ordinary annuity.

A The period of time during which accumulated money is converted into income payments b The period of time spanning from the accumulation period to the annuitization period c The period of time during which money is accumulated in an annuity d The period of time spanning from the effective date of the contract to the date of its termination. Which of the following statements best describes an ordinary annuity. Either the amount paid into the plan or the cash value of the plan whichever is the greater amount Term.

In contrast an ordinary annuity generates payments at the end of the period. Violation of unfair discrimination law may result in all of the following penalties EXCEPT The cost of coverage is based on the ratio of men and women in the group. Describe How Atp Is Produced in the Light Reactions.

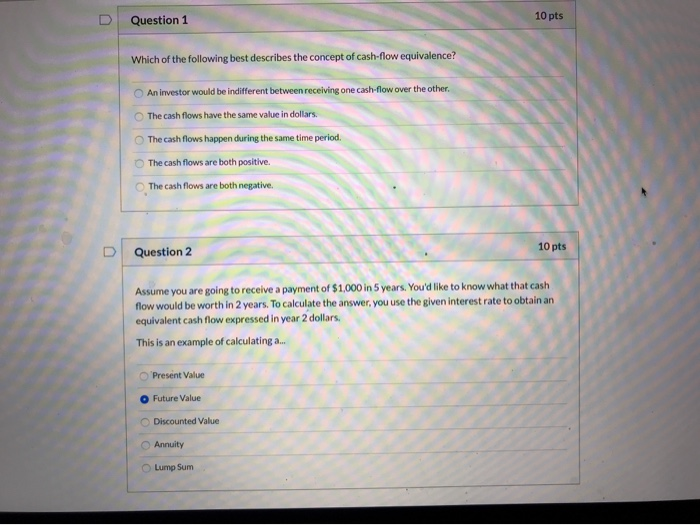

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization. Which Is the Best Waist Trainer to Buy. Which of the following best describes what the annuity period is.

Your client plans to retire at. 6 Which of the Following Sentences Is Correct. The present value of a.

Solved Which Of The Following Best Describes The Structure Chegg Com

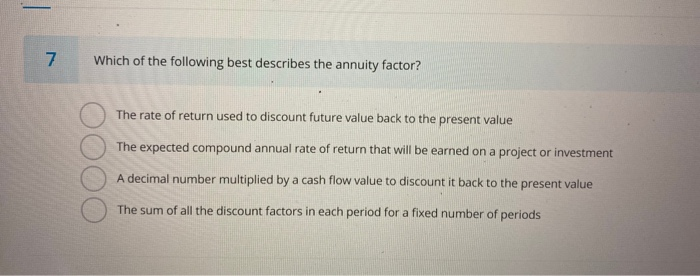

Solved D Question 1 10 Pts Which Of The Following Best Chegg Com

Solved If You Need 5 000 In 4 Years Time And Your Chegg Com

Solved Which Of The Following Best Describes The Structure Chegg Com

0 Comments